Daniel Montville understood a debt consolidation loan won’t solve his financial trouble, nevertheless the medical care nurse expected it could provide your some respiration place. He’d currently recorded for personal bankruptcy as soon as, in 2005, and was actually determined to not ever do it again.

The payday lenders just about washed his checking account everytime an income landed, making small revenue for necessities. Next their daughter forgotten their work, additionally the $5,000 income tax refund she got assured to him as payment gone alternatively to encouraging the woman family.

A?aAThat’s once I wised up and knew it was a no-win circumstances,A?aA? states Montville, 49, of Parma, Kansas. Montville happens to be repaying his creditors under a five-year section 13 case of bankruptcy payment strategy.

Debt consolidating feels like the response to a striving debtor’s prayer, but it often does not address the overspending that brought about your debt in the first place. Within a short time, consumers usually see themselves hidden much deeper in costs.

Montville took from the financing in 2015, but within a year he had fallen behind on their repayments and on the payday advances he have got to let his girl, an individual mummy with four children

A?aAIt’s an instant resolve,A?aA? says Danielle Garcia, a credit score rating therapist with American monetary expertise in Bremerton, Arizona. A?aAThey are not fixing the basis of the problem.A?aA?

The five-year, $17,000 loan Montville got from their credit union, like, paid down 10 high-rate credit card bills, lowered the interest rate regarding loans from dual digits to about 8 % and provided a fixed payment per month of $375, below just what he had been paying matched on cards.

When his child experienced economic dilemma, the guy considered payday advance loan because their cards are maxed out

Just what mortgage didn’t carry out, but was actually change https://paydayloanadvance.net/payday-loans-nv/ Montville’s expenses behavior. Paying off the credit cards merely offered your more area to recharge.

Many debt originated from unanticipated expenses, such as car maintenance. But Montville estimates sixty percent originated in A?aAfoolish spending.A?aA?

A?aAI wanted a television. I had to develop clothing. I would like to visit a film,A?aA? Montville says. When he bought a computers, he seen only the low payment of $35, not the 25 % interest rate he had been are charged.

Since he can no longer acquire – his credit card reports were sealed, in which he would want the personal bankruptcy court’s permission to displace their car – Montville finally was thinking about exactly what the guy really must buy against just what the guy wants to buy. He considers whether he can carry out without a purchase or put it off. If the guy wants something, he preserves because of it.

Montville’s lawyer, Blake maker, states a lot of his people don’t know just how her spending stack up against her earnings. They believe that her further taxation refund or stretching of overtime enable them catch-up, not realizing they are regularly spending a lot more than they make.

Several of his people consolidated her loans using a 401(k) mortgage or property equity personal credit line. They pleasure themselves on saving cash simply because they decreased their interest prices, but they don’t realize they can be investing assets – your retirement account and room assets – that typically could be protected from lenders in case of bankruptcy legal.

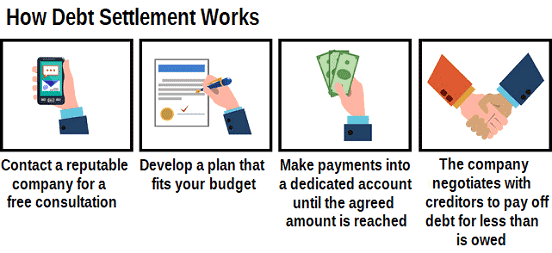

People looking for debt consolidation can end up with debt settlement enterprises, which vow to persuade creditors to simply accept below whatever they’re due. Debt consolidation typically trigger an important success to credit ratings, but triumph actually assured and some firms simply go away completely aided by the thousands they demand.

Debt consolidation reduction loans – through a credit union or a reliable online lender – don’t have to getting a disaster if consumers:

Most importantly, her financial obligation ought to be workable and payable within the three- to five-year name of the common debt consolidation financing. When it would take longer than five years to pay off the debt on their own, borrowers should consult a credit counselor or bankruptcy lawyer.

Liz Weston was a certified economic planner and columnist at NerdWallet, a personal financing site, and writer of A?aAYour Credit Score.A?aA? Email: . Twitter: